Are you thinking about applying for a loan? Whether you're looking for a mortgage, auto loan, or personal loan, getting pre-approved can give you a serious advantage. Pre-approval shows lenders that you're a strong borrower and helps you secure better interest rates, negotiate more effectively, and streamline the loan process.

So, how does loan pre-approval work, and why should you consider it before applying? Let's break it down.

What Is Loan Pre-Approval?

Loan pre-approval is a process where a lender evaluates your financial situation and determines how much they're willing to lend you—before you apply for a loan. Unlike pre-qualification, which is a quick estimate, pre-approval involves a more thorough check of your:

• Credit score

• Income and employment status

• Debt-to-income (DTI) ratio

• Financial history

Once pre-approved, you’ll receive a letter stating the loan amount, interest rate, and terms you qualify for. This document can be a game-changer when shopping for loans, giving you a clearer picture of what you can afford and improving your negotiating power.

Benefits Of Loan Pre-Approval

Getting pre-approved before applying for a loan comes with several advantages.

1. Better Interest Rates

Lenders see pre-approved borrowers as lower-risk, which can lead to lower interest rates. A lower rate means less money spent on interest over the life of the loan, saving you hundreds or even thousands of dollars.

2. Stronger Negotiation Power

When you’re pre-approved, you know exactly how much you qualify for. This puts you in a better position to negotiate with lenders, auto dealerships, or home sellers, as they’ll see you as a serious and financially prepared buyer.

3. Speeds Up The Loan Process

Since pre-approval involves a detailed financial review upfront, the final loan approval process can be faster and smoother. Lenders already have your information, reducing delays and paperwork when you're ready to finalize the loan.

4. Gives You A Clear Budget

Pre-approval helps you understand how much you can afford before purchasing. Whether you're buying a home or a car, knowing your borrowing limit prevents you from overspending or wasting time on loans you won't qualify for.

5. Reduces The Risk Of Loan Denial

Applying for a loan without pre-approval can be risky—there's always a chance you won't qualify or will receive unfavourable terms. Pre-approval allows you to identify potential issues early, allowing time to improve your financial profile if needed.

Pre-Approval Vs. Pre-Qualification: What’s The Difference?

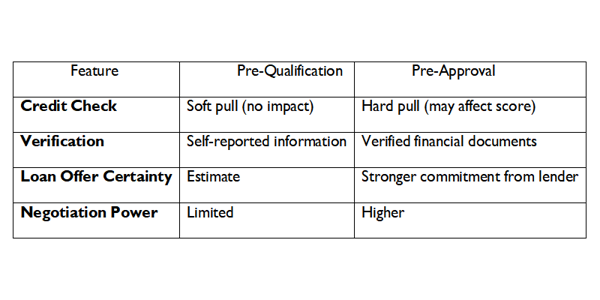

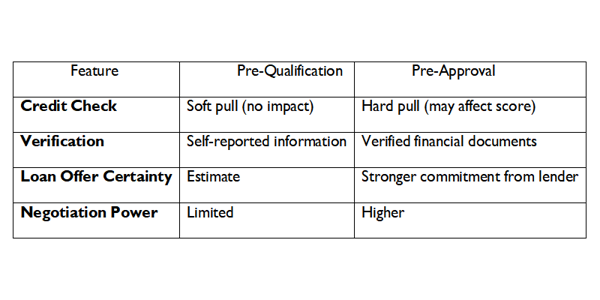

Many borrowers confuse pre-approval with pre-qualification, but they are not the same:

Pre-approval is a more reliable indicator of loan eligibility and gives borrowers an advantage when securing deals.

How To Get Pre-Approved For A Loan

If you’re considering pre-approval, follow these steps to improve your chances of getting the best loan terms:

1. Check Your Credit Score

Lenders use your credit score to determine loan eligibility and interest rates. A higher score increases your chances of approval and getting better loan terms. If your score is low, consider improving it before applying.

2. Gather Your Financial Documents

Most lenders require documents such as:

• Proof of income (pay stubs, tax returns)

• Employment verification

• Bank statements

• Debt and asset information

3. Compare Lenders

Different lenders offer different pre-approval terms. Shopping around can help you find the best interest rates and loan conditions. Look at banks, credit unions, and online lenders.

4. Submit a Pre-Approval Application

Once you’ve chosen a lender, complete their pre-approval application. This may involve a hard credit check, which can temporarily lower your credit score, so only apply when you’re serious about taking out a loan.

5. Review Your Pre-Approval Offer

If approved, review the terms carefully. Pay attention to:

• Loan amount

• Interest rate

• Loan term

• Fees and conditions

Use this information to compare lenders or negotiate better terms.

When Should You Get Pre-Approved?

Pre-approval is most useful when you’re actively looking for a loan. Here’s when it makes sense:

Before House Hunting

Real estate agents and sellers take pre-approved buyers more seriously.

Before Car Shopping

Pre-approval gives you an upper hand in negotiations with dealerships.

Before Applying For A Personal Loan

Knowing your rate in advance helps you compare lenders more effectively.

Pre-approvals typically last 30 to 90 days, so time your application carefully.

Does Pre-Approval Guarantee Loan Approval?

Not always. Even if you’re pre-approved, final approval depends on additional factors, such as:

• Changes in your credit score

• Additional debt is taken on before final approval

• Employment or income changes

• Property appraisals (for mortgages)

To increase your chances of final approval, avoid making significant financial changes after receiving a pre-approval letter.

Common Mistakes To Avoid During The Pre-Approval Process

While getting pre-approved can give you an advantage, making inevitable mistakes can hurt your chances of securing the best loan terms—or even lead to denial during final approval. Here are some common pitfalls to watch out for:

Applying With Multiple Lenders At Once

While comparing lenders is essential, too many hard credit inquiries in a short period can lower your credit score. To minimize the impact, try to complete all pre-approval applications within two weeks, as credit bureaus typically treat multiple inquiries within this timeframe as a single inquiry.

Taking On New Debt Before Final Approval

Once pre-approved, avoid opening new credit cards, financing large purchases, or taking out additional loans. Lenders reassess your financial situation before final approval, and any new debt could change your eligibility or lead to higher interest rates.

Overlooking Fees And Loan Terms

Many borrowers focus only on the loan amount and interest rate but forget to check for hidden fees, such as origination fees, prepayment penalties, or closing costs. Always read the fine print to ensure you understand the cost of borrowing.

Not Maintaining Stable Employment

Lenders want to see steady income, so switching jobs or experiencing gaps in employment after pre-approval can raise red flags. Avoid significant career changes until after your loan is finalized.

Ignoring The Expiration Date On Your Pre-Approval

Pre-approvals typically last 30 to 90 days. If your pre-approval expires before you finalize your loan, you may need to reapply, which could mean another credit check and potentially different loan terms.

Making The Most Of Loan Pre-Approval

Loan pre-approval is valuable because it can help you secure better interest rates, streamline the loan process, and strengthen your negotiating power. By checking your credit, comparing lenders, and understanding the terms of your pre-approval, you can position yourself for the best possible loan deal.

Remember to avoid making significant financial changes after receiving pre-approval, such as taking on new debt or missing payments, as this could impact your final approval. With careful planning and intelligent decision-making, loan pre-approval can be a key tool in securing a loan that fits your financial goals.